Why Your Business Requirements a 2D Payment Gateway for Seamless Deals

Why Your Business Requirements a 2D Payment Gateway for Seamless Deals

Blog Article

The Duty of a Settlement Portal in Streamlining Ecommerce Settlements and Enhancing Customer Experience

The integration of a settlement gateway is essential in the ecommerce landscape, serving as a safe and secure channel in between consumers and sellers. By allowing real-time purchase processing and sustaining a variety of settlement techniques, these portals not just reduce cart desertion however additionally enhance general customer contentment.

Understanding Settlement Gateways

A repayment portal serves as an essential intermediary in the ecommerce transaction process, promoting the protected transfer of repayment details between vendors and consumers. 2D Payment Gateway. It enables on the internet organizations to accept numerous types of payment, including credit cards, debit cards, and electronic budgets, hence expanding their client base. The portal runs by encrypting sensitive info, such as card information, to guarantee that information is transmitted securely online, minimizing the threat of scams and data breaches

When a client initiates a purchase, the repayment gateway captures and forwards the transaction information to the appropriate economic organizations for authorization. This procedure is typically seamless and occurs within seconds, supplying customers with a fluid shopping experience. Additionally, repayment entrances play an essential role in compliance with industry standards, such as PCI DSS (Settlement Card Industry Data Security Criterion), which mandates strict safety measures for refining card repayments.

Understanding the auto mechanics of settlement gateways is crucial for both customers and merchants, as it straight affects purchase performance and client depend on. By making sure safe and effective transactions, settlement portals contribute significantly to the total success of shopping businesses in today's electronic landscape.

Key Attributes of Payment Gateways

Several essential functions specify the performance of repayment gateways in ecommerce, ensuring both protection and ease for individuals. One of the most important functions is durable safety and security procedures, consisting of file encryption and tokenization, which secure sensitive client information throughout transactions. This is crucial in promoting trust in between sellers and consumers.

Additionally, real-time transaction processing is essential for making certain that settlements are finished quickly, minimizing cart abandonment prices. Settlement entrances additionally use fraud detection tools, which check transactions for suspicious task, more protecting both merchants and consumers.

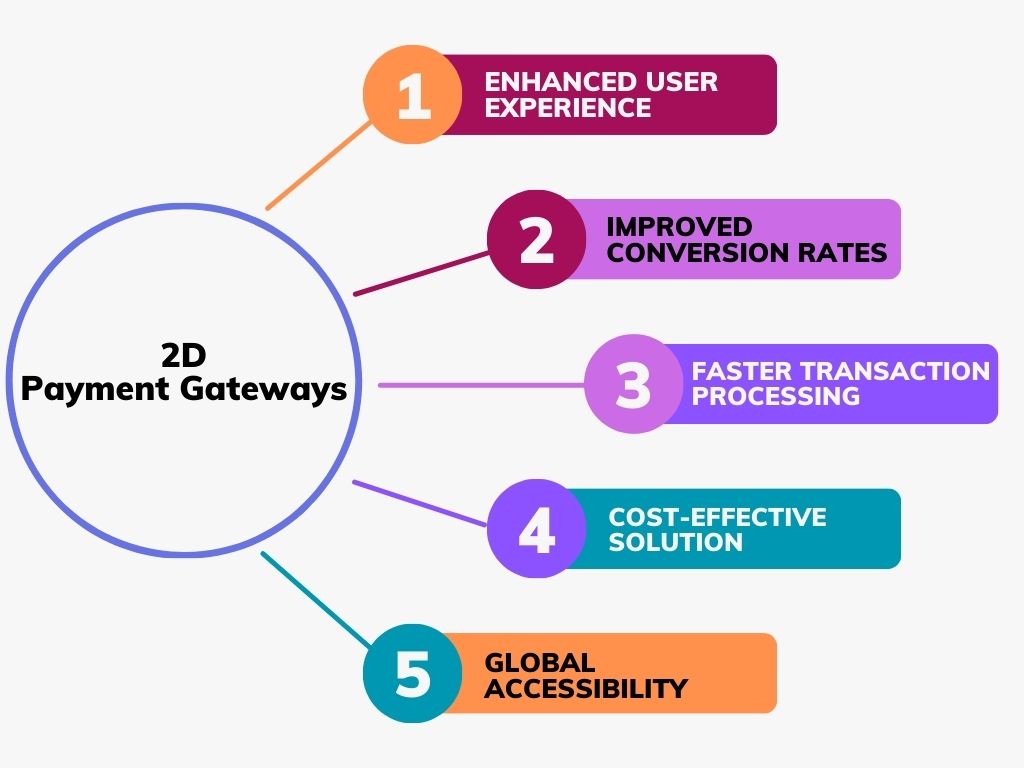

Benefits for E-Commerce Services

Various benefits emerge from integrating repayment gateways right into e-commerce services, substantially enhancing functional performance and consumer fulfillment. Most importantly, repayment gateways help with seamless deals by securely refining settlements in real-time. This capability lowers the chance of cart desertion, as customers can quickly complete their purchases without unnecessary delays.

Additionally, payment gateways sustain numerous settlement methods, fitting a diverse array of customer preferences. This versatility not just brings in a broader customer base yet also promotes loyalty among existing customers, as they really feel valued when supplied their recommended settlement options.

Additionally, the assimilation of a repayment gateway commonly causes improved safety and security features, such as security and fraud discovery. These procedures protect delicate client details, consequently building trust fund and integrity for the ecommerce brand name.

Moreover, automating payment procedures through portals reduces hand-operated work for personnel, permitting them to focus on critical efforts instead of routine jobs. This functional efficiency converts into price savings and enhanced source allowance.

Enhancing Individual Experience

Incorporating an effective repayment portal is important for boosting user experience in shopping. A effective and seamless payment procedure not only constructs consumer count on yet also reduces cart desertion prices. By giving several repayment alternatives, such as bank card, digital wallets, and financial institution transfers, companies satisfy diverse customer preferences, consequently read the article boosting satisfaction.

Furthermore, an easy to use user interface is important. Repayment entrances that use instinctive navigating and clear guidelines allow consumers to full purchases promptly and easily. This convenience of usage is vital, particularly for mobile customers, that call for maximized experiences customized to smaller sized screens.

Protection attributes play a substantial role in user experience. Advanced encryption and fraudulence discovery systems guarantee clients that their sensitive data is secured, promoting confidence in the transaction procedure. Furthermore, transparent communication why not find out more concerning policies and costs boosts reliability and reduces possible irritations.

Future Patterns in Payment Handling

As shopping remains to develop, so do the technologies and fads forming repayment processing (2D Payment Gateway). The future of settlement processing is marked by a number of transformative trends that assure to improve efficiency and individual complete satisfaction. One substantial pattern is the rise of fabricated intelligence (AI) and machine understanding, which are being significantly integrated right into payment portals to bolster protection with advanced fraud discovery and risk evaluation

Additionally, the adoption of cryptocurrencies is obtaining traction, with even more companies discovering blockchain innovation as a sensible alternative to standard payment techniques. This change not only uses reduced deal costs but likewise allures to a growing group that values decentralization and personal privacy.

Contactless repayments and mobile purses are becoming mainstream, driven by the demand for much faster, more convenient transaction techniques. This fad is more fueled by the enhancing occurrence of NFC-enabled tools, enabling smooth transactions with just a tap.

Finally, the focus on governing conformity and information protection will certainly form payment processing methods, as organizations make every effort to build count on with customers while sticking to advancing lawful structures. These fads jointly show a future where repayment handling is not just quicker and a lot more safe and secure yet additionally extra aligned with consumer assumptions.

Verdict

In final thought, settlement gateways act as important elements in the shopping community, promoting effective and secure deal handling. By supplying diverse payment choices and focusing on customer experience, these gateways substantially reduce cart abandonment and improve client satisfaction. The ongoing development of payment innovations and protection measures will even more enhance their function, making sure that shopping organizations can satisfy the demands of increasingly advanced consumers while promoting trust and reliability in online deals.

By allowing real-time deal processing and supporting a selection of settlement approaches, these portals not just minimize cart desertion however additionally boost total consumer contentment.A settlement portal serves as a vital intermediary in the ecommerce transaction process, facilitating the secure transfer of settlement details between sellers and customers. Repayment entrances play a crucial role in conformity with market requirements, such as PCI DSS (Payment Card Sector Information Safety Standard), which mandates strict security actions for processing card payments.

A functional repayment gateway suits credit rating and debit cards, digital pocketbooks, and alternate payment you could try this out techniques, catering to varied customer choices - 2D Payment Gateway. Payment gateways assist in seamless deals by securely refining payments in real-time

Report this page